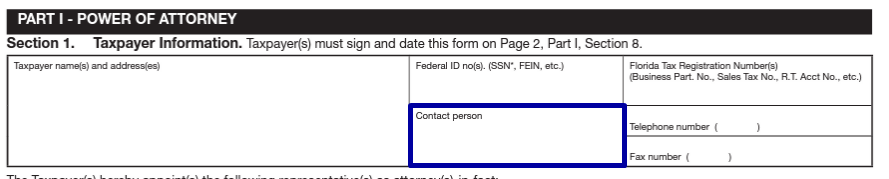

Florida Department of Revenue: Power of Attorney

Florida Department of Revenue Power of Attorney Form, or Form DR-835, is a legal document that gives a person a right to assign his or her accountant or any other person to get access to the taxpayer’s information, as well as file the taxes on the behalf of the payer.

This Florida POA form can be quite useful when you have an accountant that knows the taxes better than you, or when you are in a situation that cannot allow you to file and the due date is expiring.

Note that you can specify the amount of time for which this person will have access to your tax information, and we strongly recommend you to do that, as no one knows how the trustee’s actions can change with time.

Guide on How to Fill in the Form

Your first action would be to find the form and decide how you would want to fill it: with the help of your browser, some program, or simply by hand. In the last case, be very accurate with your writing.

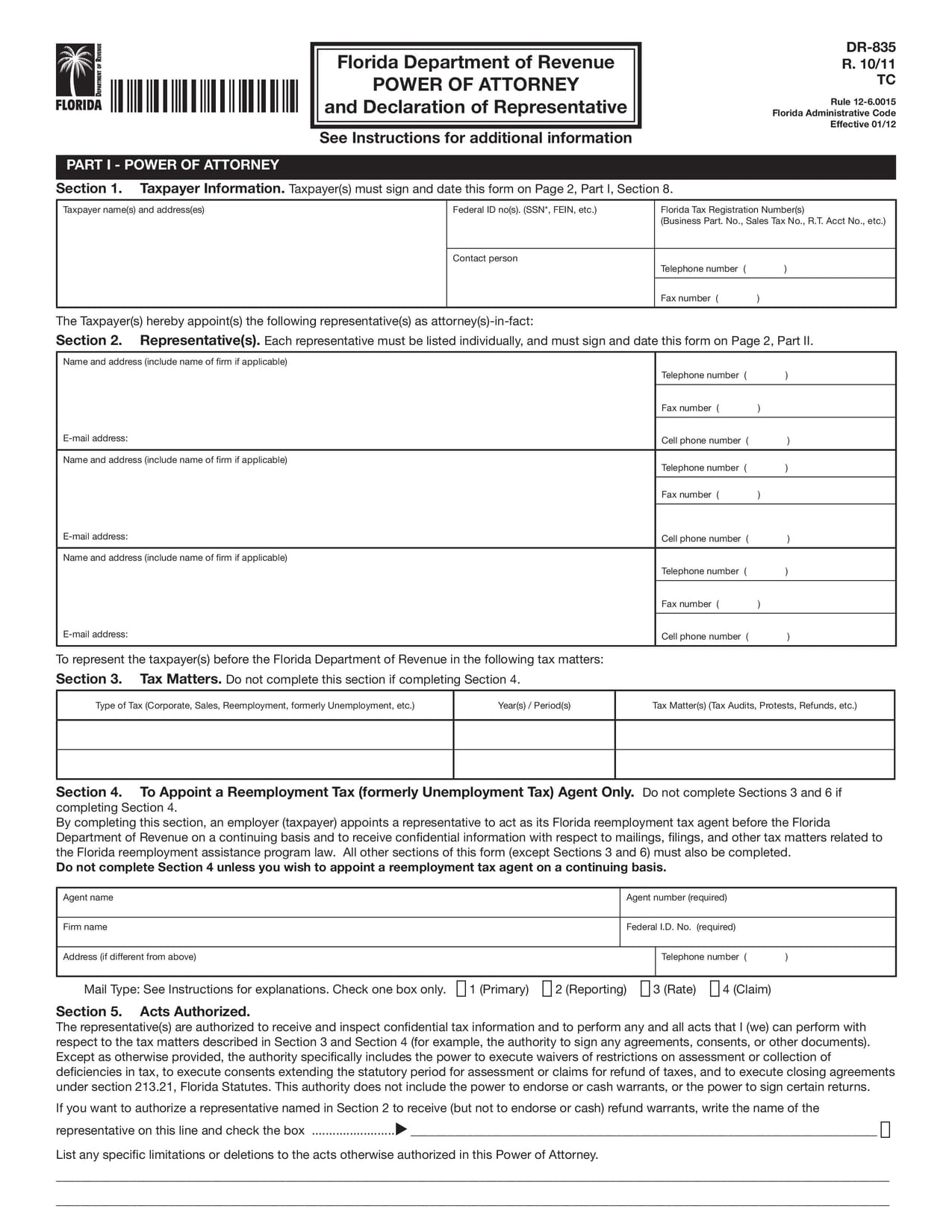

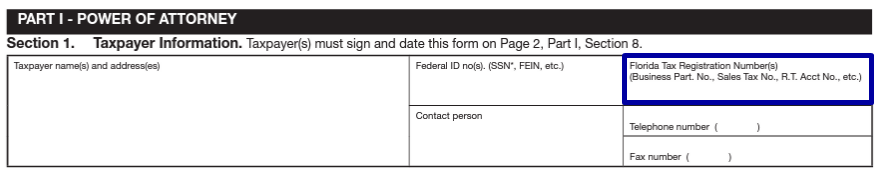

Section 1: Taxpayer Info

Logically, here you would need to write down all the information that is connected to the principal, or the taxpayer.

This can be a various choice:

- You as an individual,

- Individual enterprise

- A whole corporation

- Partnership

- An estate

- Limited liability company

- Trust

Note that as many entities can file this form, not all of the cells should be written out by each of them. File in only those related to your type of principal taxpayer, but all should write down the name and the current address.

In this article, we will focus on an individual entity.

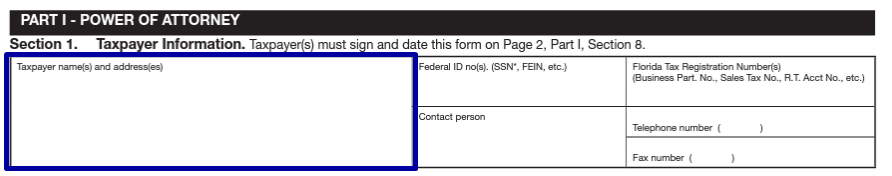

Next, go to the “Federal ID” cell and fill in your Identification Number: for a person it would be a Social Security one.

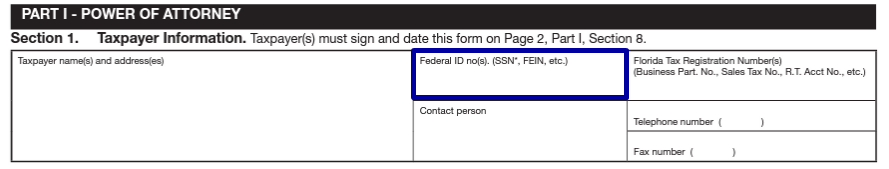

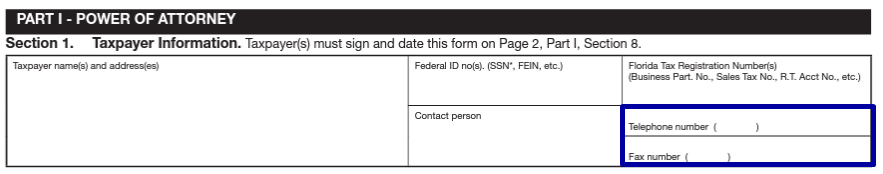

If some particular person (or you) is appointed for all of the communication, then fill in the name of this person in the “Contact Person” cell.

Also, if you have a business and a Florida Tax Registration Number, fill it out in the corresponding cell.

Do not forget to write down your Telephone and Fax Number, and leave the latter cell blank if you do not have a Fax.

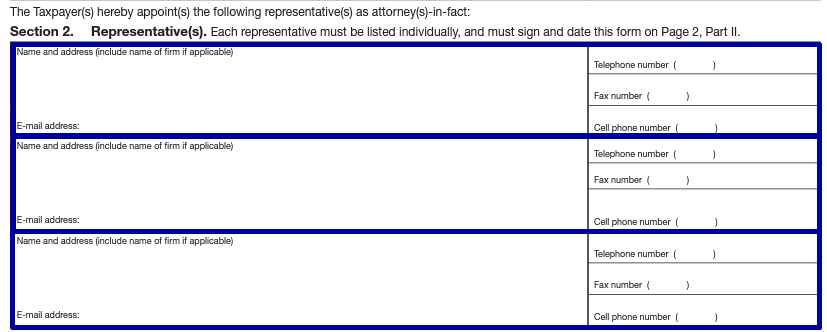

Section 2: Representatives

Correspondingly, here you need to fill out the information regarding your agents: no less than one and no more than three can be put in the Florida Department Of Revenue Power of Attorney.

When you want to have more than one agent with principal power, put them into separate columns and fill out all the information that your agents have and that the form is requiring.

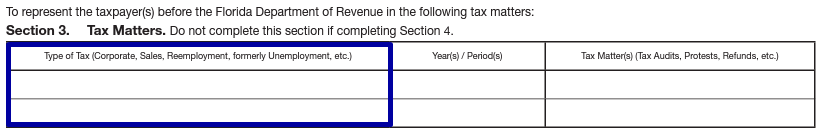

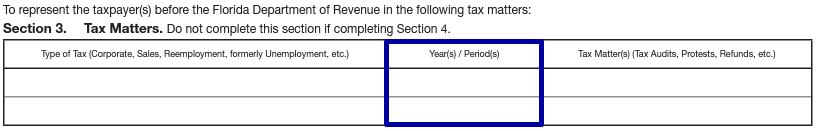

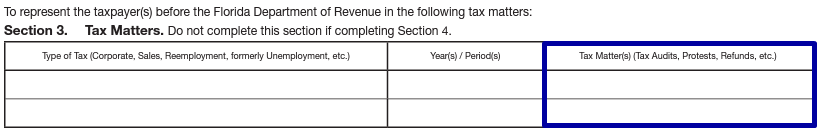

Section 3: Tax Matters

Be aware that you can only assign an authority agent in taxes either using section three OR section four. Both cannot be used in one form.

Using this section, write down all of the cells that are needed, including:

- “Type of tax”, such as Claims

- “Year(s)Period(s)”, during which the agent will have a tax authority

- “Tax Matters” to specify exactly for what the agent has a right to file, such as Refunds

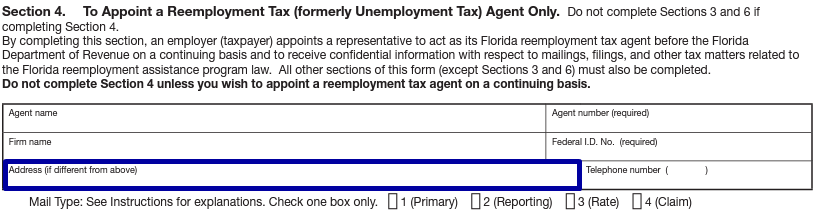

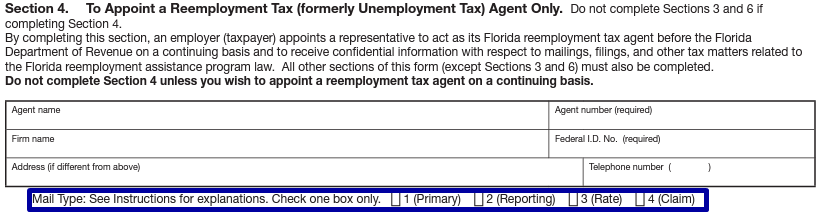

Section 4: To Appoint a Reemployment Tax Agent

If choosing this section to assign your Florida reemployment tax agent, skip sections three and six.

Note that address information here should be filled in only if it differs from that of section two.

Also, be careful when choosing the level of communication of IRS with your agent. Choose:

- The first box if you want all of the information to be sent to your agent

- The second box for the quarterly report and all the reporting correspondence to be sent

- The third box for all the tax rate info to be sent

- The fourth box for all claim matter correspondence to be sent

Section 5: Authorized Acts

Any specific restrictions can be placed in this section, just follow the information in the cells and fill out those that you need.

Section 6: Notes and Communication

Note that this section is NOT filled out if you previously have chosen section four instead of section three.

If section three was chosen, then you should fill in this one as well. Simply mark the checkbox of your preference.

Section 7: Retention/Nonrevocation of Prior Power(s) of Attorney

If you want to revoke the previous tax authority, then fill in this section and attach a copy of the previous form. Otherwise, leave this section blank.

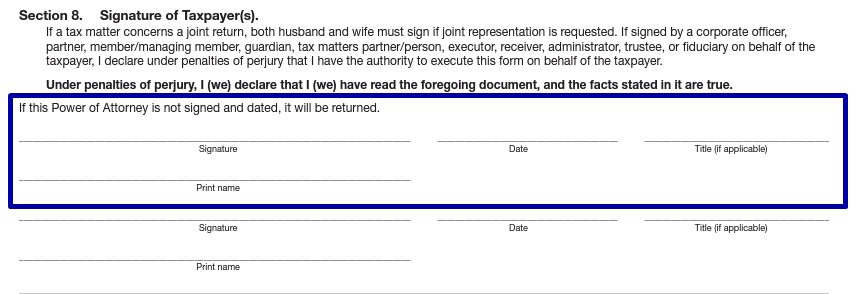

Section 8: Signature of Taxpayer(s)

This section is an absolute must for filling out by the taxpayer(s). If there are two of you (for example, a spouse or a business partner), both of you should fill out this section thoroughly.

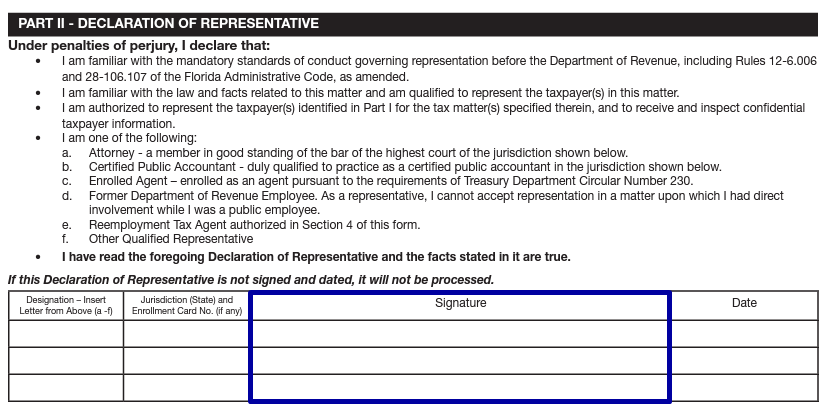

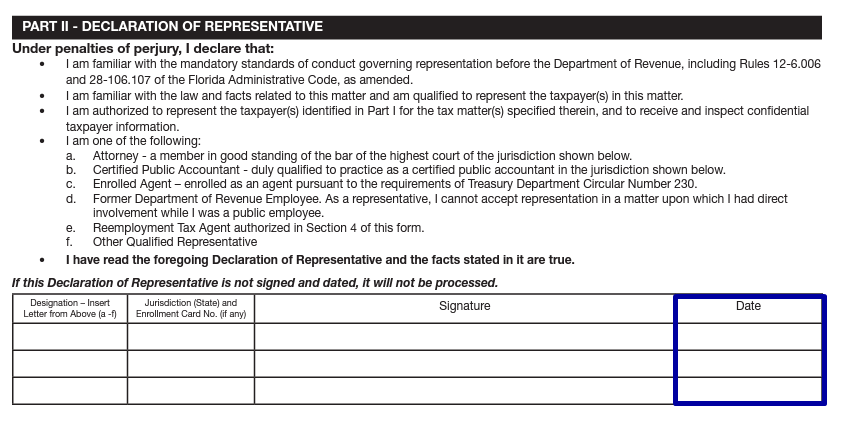

Part II: Representative Acknowledgement

In this section, the agents may provide some of their information, as well as the signature of the POA form, with all of the information there read through and all of the columns being completed, including:

- The designation column

- The Jurisdiction column

- Signature and date

Now your POA form is completely finished and can be sent out to the Florida Department of Revenue.